The Shocking Truth Behind the Strivers Community - Is It Too Good to Be True?

Blink your eyes and there’s another pyramid scheme built in a neighbourhood near you. Or maybe that’s not the case? I certainly hope so. What I’m referring to is the latest get rich quick scheme circulating on social media, Strivers Community aka ‘WhatsApp Stokvel 2.0’.

Having previously written on the WhatsApp Stokvel of 2020, it seems the latest money making scheme Strivers Community is upping the stakes and rewards - For a joining fee of N$5,700 earn a return of N$22,800 guaranteed, no questions asked. I’ll explain in more detail later in the blog.

Are Stokvels Illegal?

No not at all. Founder and President of the National Stokvel Association of South Africa (NASASA) Andrew Lukhele explains ‘A stokvel is a type of [informal] credit union in which a group of people enter into an agreement to contribute fixed sums of money to a common pool on a weekly, fortnightly or monthly basis’.

A stokvel has been used by our disadvantaged parents to pool money during the Apartheid era when financial freedom was really against them. Being discriminated against by Apartheid banks because of race, black people had to make a plan by coming together. Pooling their financial resources together, they were able to cope with economic hardship.

This money would be used for an array of needs, such as general savings, education, burials, groceries, business ventures etc. This type of traditional savings continues to this day. Stokvels are very commonplace in South Africa, being regulated by NASASA.

Although stokvels are not extensively researched, existing data from South Africa illustrates to what extent money is pooled via stokvel. In 2019, stokvels in South Africa have an estimated value of R49 billion and a membership of 11,5 million people (out of a population of 57 million).

The same research paper made compelling reasons for formally including stokvels into the economy as it may help reduce unemployment, help broadening equitable access to ownership of the economy and capital accumulation.

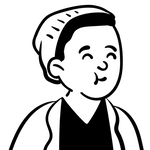

Stockvel vs Pyramid Scheme

Stokvel: has a fixed number of members; each member contributes the exact amount each round; members are motivated by a pact/commitment they made with their friends/ family and; the money put in is the exact same amount received in a lump sum.

An excerpt taken from CSMonitor illustrates a typical Stokvel:

So when a colleague at the college dorm suggested Ms. Chuma join a saving and lending club – known locally as a stokvel – she jumped at the chance.

The premise was simple. Each month, one of the six women received 1,000 rand from each of the other five, so that each member got a payout of 5,000 rand twice a year. For Ms. Chuma, it was the first time in her life she’d been able to save a sum anywhere near that large.

Pyramid scheme: requires new members to join for the organization to continue operating; each member has to contribute a joining fee; members are motivated by absurd profits and; money put in will multiply unapparent.

Example:

Payout = ‘Guaranteed returns’ + bonuses (100% commission)

Joining fee is N$5700. Joining at the base of the pyramid is called Stage D. If you manage to get two referrals/recruits, you will move up the pyramid to Stage C. A referral should also pay N$5700.

The guaranteed amount payed out is N$22,800. Amount payable is anywhere from N$22,800 to N$120,000.

Should you Invest in it?

Please note this is not financial advice

Amongst your most trusted friends and family, stokvel is a good idea because it is practical. Joining a group always helps If you are struggling to do something (i.e save money).

However, in the case of a pyramid scheme, the danger comes at the tail end of the scheme. It’s easy to lose sight of the potential risk when seeing other people’s ‘bank balances’.

Even I was bamboozled looking at screenshots of such balances before someone told me photoshop does exist. 🤦♂️ (Stoopid, Dummy in Tekashi 6ix9nine’s voice).

In conclusion, I personally believe that the Strivers Community is a house of cards.

People who make real money are the original members who are able to cash their chips at the right moment.

It’s all about getting in and getting out before the structure eventually collapses.

If you’re reading this, you’re probably too late. Any company that can create 2100% in returns from thin air deserves skepticism on it’s business practices. I give that squint of the eyes like I’m Clint Eastwood in an old western.

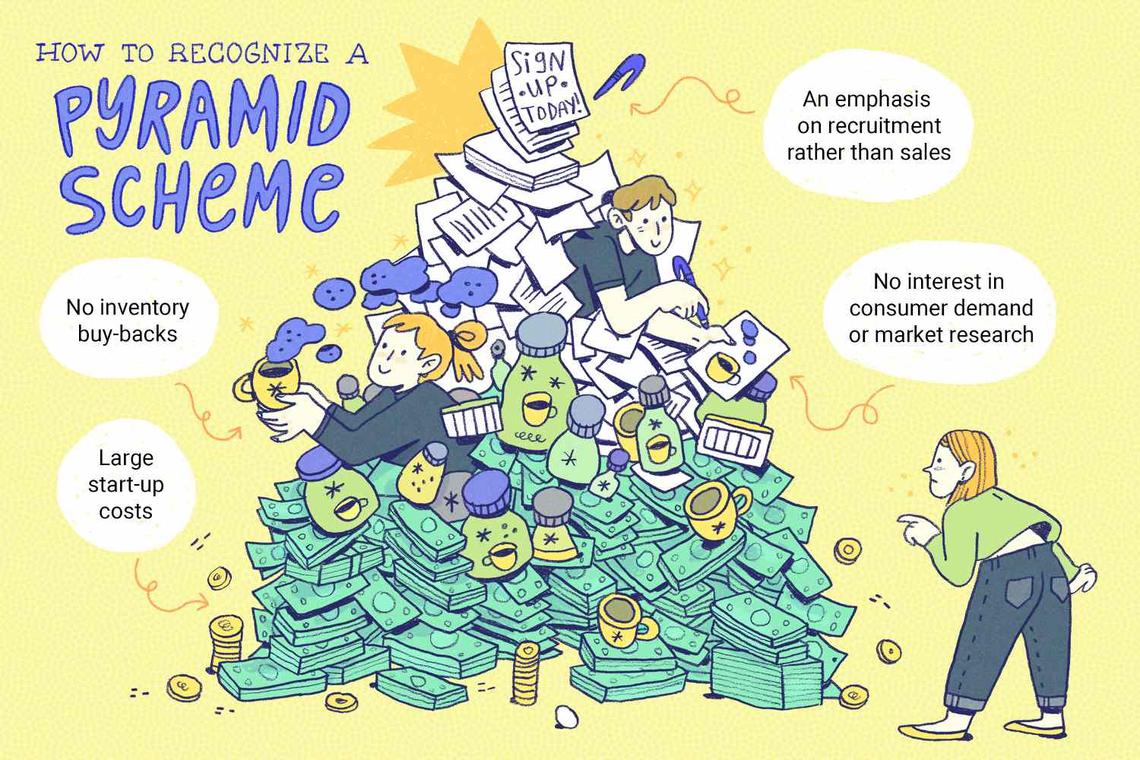

The Bank of Namibia recently released a notice to the public, warning of illegal financial schemes incoming during the festive season. If you have been victim to such schemes, report this today. Call 0612835011 or email illegalschemes@bon.com.na.

*For better understanding on WhatsApp Stokvel, a link to the YouTube videos Stokvels vs Pyramid Schemes: What’s the Difference? by Foster Digital Education and To WhatsApp Stokvel or NOT by Nicolette Mashile are included.

*For a full analysis on Stokvel, a link to the research paper ‘Stokvels- A Hidden Economy: Unpacking the potential of South African traditional savings schemes.’ is included.

Share

Related Posts

Quick Links

Legal Stuff